Cryptocurrency news

Launched in 2015 by Vitalik Buterin and other developers, Ethereum expands on Bitcoin’s concept by allowing not just peer-to-peer transactions but also programmable contracts that execute automatically when conditions are met https://casino-las-atlantis.com/. These smart contracts power a wide range of applications, from decentralised finance (DeFi) to non-fungible tokens (NFTs).

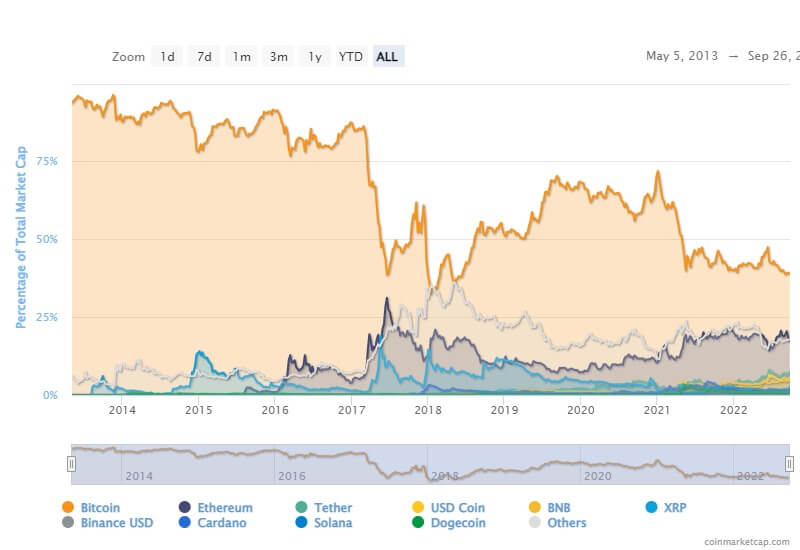

From Bitcoin and Ethereum to an ever-growing list of altcoins, cryptocurrencies have taken a new generation of investors around the world by storm. Fast-moving and volatile, this industry keeps participants, observers, and regulators on their toes. As mainstream companies explore cryptocurrencies and blockchain technologies for new markets — or even to build them within virtual worlds — the crypto space is in a rapid state of evolution.

NewsNow aims to be the world’s most accurate and comprehensive Ethereum news aggregator, bringing you the latest Ethereum news from the best Cryptocurrency sites and sources. Whether it’s Ethereum price, Ethereum news today or ETH news now, we’ve got it covered – breaking news from each site is brought to you automatically and continuously 24/7, within around 10 minutes of publication.

Cryptocurrency market news april 2025

In regulatory news, the Federal Reserve said that it had withdrawn earlier guidance about commercial banks’ crypto- and stablecoin-related activities. Previously the Fed had required banks to give advance notice before undertaking any crypto activities; under the updated guidance the Fed will consider banks’ crypto activity as part of its normal supervisory process. Separately, at an event in mid-April, Fed Chair Powell said about the crypto industry: “I think that the climate is changing, and that you are moving into more mainstreaming of that whole sector.” Powell added that he was encouraged by progress on stablecoin legislation in Congress. Although House and Senate negotiators need to iron out some differences, passing stablecoin legislation over the next month still appears possible.

In the current high interest rate environment maintained by the Fed, the carry trade opportunities for long-term securities (such as US Treasuries) become more attractive, encouraging foreign investors to increase positions to lock in higher returns. Foreign investors tend to “buy long, sell short,” meaning increasing holdings of medium and long-term US bonds while reducing short-term securities. This strategy may reflect bets on the Fed’s future rate cut path: if rate cuts are delayed, long-term yields remain relatively stable; if rate cuts begin, long-term bond prices will benefit from declining rates.

CFTC withdraws staff advisory related to virtual currency derivative product listings. Also on March 28, the CFTC’s Division of Market Oversight (DMO) announced it was withdrawing Staff Advisory No. 18-14, which provided guidance and suggested greater burdens for listing virtual currency derivatives products. The DMO cited “additional staff experience” and “increasing market growth and maturity” as reasons for withdrawing the advisory.

Whether it’s pessimistic or optimistic depends on key data and event nodes at that time, such as April 2 tariff details, which need clarity on the scope of taxation, rates, and exemption clauses. If the policy is “more bark than bite,” the market may quickly digest the negative news; and April PCE inflation data: if core PCE continues to be above 2.8%, it may strengthen the Fed’s hawkish stance, suppressing the crypto market; specific data to watch includes Bitcoin ETF fund flows, institutional fund movements (such as BlackRock’s continued buying/selling) are important indicators for measuring market confidence.

In addition to reporting on the law and regulation governing blockchain, smart contracts, and digital assets, this bulletin will discuss the legal developments supporting the infrastructure and ecosystems that enable the use and acceptance of these new technologies.

Cryptocurrency news predictions

Despite the launch of nine spot Ethereum ETFs, the 2024 Ethereum rally took a breather in July. The weakness may be a sign that investors are taking profits after news of the launch of the spot ETFs became public.The popular Grayscale Ethereum Trust (ETH) experienced extreme outflows in its first two days of trading.

“Between mid-February and mid-April gold was rising at the expense of bitcoin, while of the past three weeks we have been observing the opposite, i.e. bitcoin rising at the expense of gold,” JPMorgan analysts led by managing director Nikolaos Panigirtzoglou wrote in a note seen by Decrypt.

“In all, we expect the year-to-date zero sum game between gold and bitcoin to extend to the remainder of the year, but are biased towards crypto-specific catalysts creating more upside for bitcoin over gold into the second half of the year.”

The accuracy of prediction models used by CoinCodex is heavily influenced by the amount of historical data available for a particular crypto asset. For example, we feel very confident in our projected price trends for Bitcoin and other crypto assets that have been trading for a considerable amount of time. While we strive to provide the most accurate cryptocurrency price predictions possible, it’s important to note that you shouldn’t expect our models to be entirely accurate all the time. That’s especially true for predictions about crypto assets that have experienced erratic market behavior in the past or haven’t been trading that long.