All you need to know about cryptocurrency

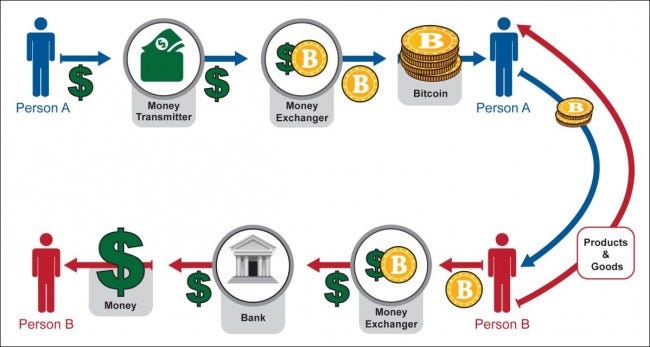

The remittance economy is testing one of cryptocurrency’s most prominent use cases. Cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders rolling slots. Thus, a fiat currency is converted to Bitcoin (or another cryptocurrency), transferred across borders, and subsequently converted to the destination fiat currency without third-party involvement.

By design, the blockchain becomes increasingly tamper-proof; a hacker today would need computing power equivalent to the majority of the computing power on the cryptocurrency network to successfully alter transactions.

All about cryptocurrency

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

An initial coin offering (ICO) is a controversial means of raising funds for a new cryptocurrency venture. An ICO may be used by startups with the intention of avoiding regulation. However, securities regulators in many jurisdictions, including in the U.S. and Canada, have indicated that if a coin or token is an “investment contract” (e.g., under the Howey test, i.e., an investment of money with a reasonable expectation of profit based significantly on the entrepreneurial or managerial efforts of others), it is a security and is subject to securities regulation. In an ICO campaign, a percentage of the cryptocurrency (usually in the form of “tokens”) is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, often bitcoin or Ether.

To ensure the highest level of accuracy & most up-to-date information, BitDegree.org is regularly audited & fact-checked by following strict editorial guidelines & review methodology. Carefully selected industry experts contribute their real-life experience & expertise to BitDegree’s content. Our extensive Web3 Expert Network is compiled of professionals from leading companies, research organizations and academia.

However, it’s important to note that to some, cryptocurrencies aren’t investments at all. Bitcoin enthusiasts, for example, hail it as a much-improved monetary system over our current one and would prefer we spend and accept it as everyday payment. One common refrain — “one Bitcoin is one Bitcoin” — underscores the view that Bitcoin shouldn’t be measured in USD, but rather by the value it brings as a new monetary system.

All about investing in cryptocurrency

Experts say that blockchain technology can serve multiple industries, supply chains, and processes such as online voting and crowdfunding. Financial institutions such as JPMorgan Chase & Co. (JPM) are using blockchain technology to lower transaction costs by streamlining payment processing.

Cryptocurrencies represent a new, decentralized paradigm for money. In this system, centralized intermediaries, such as banks and monetary institutions, are not necessary to enforce trust and police transactions between two parties. Thus, a system with cryptocurrencies eliminates the possibility of a single point of failure—such as a large financial institution setting off a cascade of global crises, such as the one triggered in 2008 by the failure of large investment banks in the U.S.

The are several ways to invest in cryptocurrency. If you’re interested and can accept the risks involved, you have many choices. However, it cannot be stressed enough how volatile crypto prices are because other cryptocurrency investors are afraid of missing out on the next big price movements.

It’s important to remember that Bitcoin is different from cryptocurrency in general. While Bitcoin is the first and most valuable cryptocurrency, the market is large — there are thousands of cryptocurrencies. And while some cryptocurrencies have total market valuations in the hundreds of billions of dollars, others are obscure and essentially worthless.

You can invest in Bitcoin directly by using one of the major cryptocurrency exchanges, such as Coinbase or Binance. Another way to gain investment exposure to Bitcoin is to buy shares in a company with significant Bitcoin exposure, such as a Bitcoin mining company. A third option is to invest in a Bitcoin-focused fund such as an exchange-traded fund (ETF).

It depends on your goals. Looking for short-term gains, then scalping and day trading would be the best strategy for you. If, instead, you are looking for long-term gains, consider position trading or holding your coins over a long period (HODL).